In today’s rapidly evolving economy, the rise of the gig economy has brought about a seismic shift in how individuals engage in work. Musicians, in particular, have found new avenues for showcasing their talent and earning income through various gig opportunities. However, this surge in non-traditional work arrangements has raised important questions about income reporting and tax obligations. For gig economy musicians, the use of W2 forms, a standard tax reporting document, plays a crucial role in accurately documenting their earnings and complying with tax regulations.

The Gig Economy Landscape for Musicians

The gig economy has provided musicians with unprecedented opportunities to monetize their skills outside the realm of traditional record label contracts. Musicians now frequently engage in one-time performances, freelance recording sessions, and streaming services. In this context, having a reliable W2 form creator becomes crucial. While these opportunities offer greater flexibility and control over their work, they also introduce complexity to the income reporting process. Unlike salaried employees who receive regular pay stubs, gig economy musicians often receive payments from multiple sources, making it essential to accurately track and report their income.

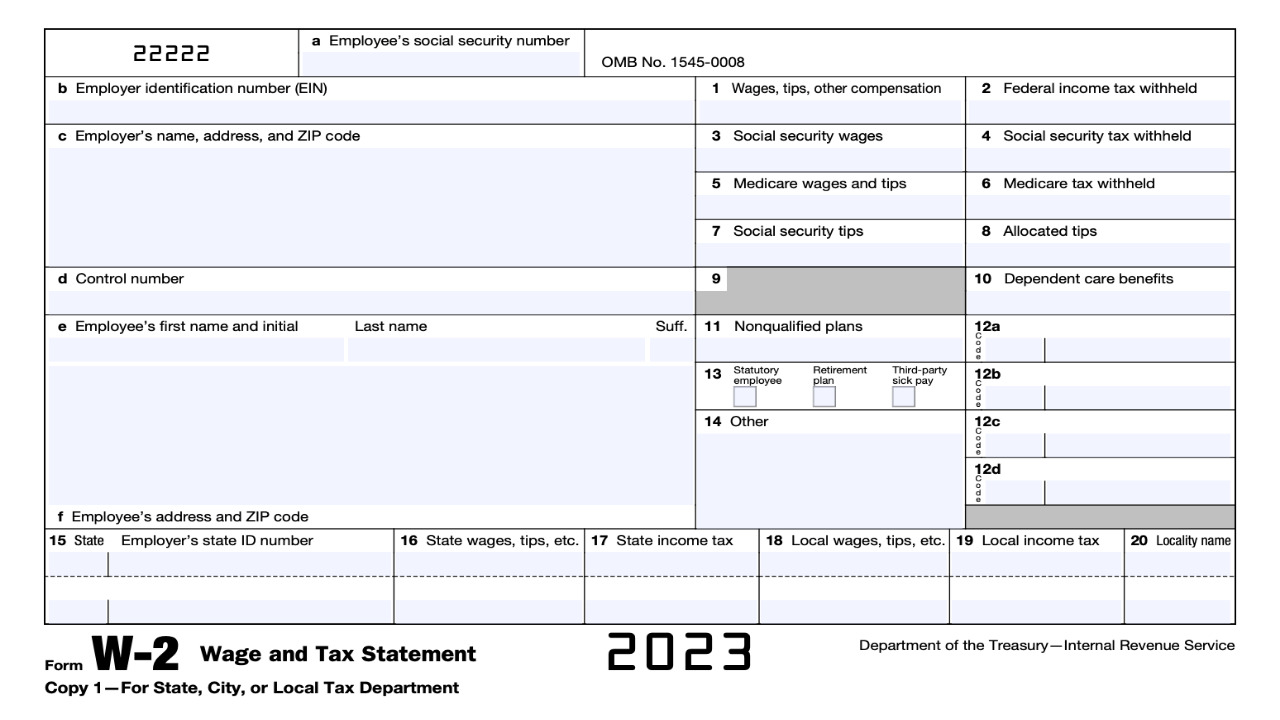

Understanding W2 Forms for Musicians

The W2 form is typically associated with traditional employment arrangements, where an employer withholds taxes from an employee’s wages and provides them with a W2 at the end of the year, summarizing their income and tax withholdings. However, for gig economy musicians who engage in part-time or occasional work, the issuance of W2 forms can still apply in certain situations. If a musician is hired by a company or organization as an employee for a specific event or project, the company may provide them with a W2 form to report their earnings and taxes withheld.

Reporting Requirements and Challenges

For gig economy musicians who receive W2 forms, accurately reporting their income can be challenging due to the sporadic nature of their work. They must diligently track each W2 received, ensuring that all their earnings are accurately reported on their tax return. Additionally, since taxes are often not automatically withheld for gig workers, musicians may need to budget and set aside funds to cover their tax liabilities. Failure to properly report income and pay taxes can lead to penalties and legal repercussions.

Seeking Professional Assistance

Given the intricacies of income reporting for gig economy musicians, seeking professional tax assistance is highly advisable. Certified public accountants (CPAs) or tax professionals well-versed in freelance and gig economy work can provide valuable guidance. These experts can help musicians navigate the complex tax landscape, identify potential deductions related to their work, and ensure accurate reporting of income from W2 forms and any additional 1099 forms they might receive.

In conclusion, the gig economy has revolutionized the music industry, providing musicians with diverse income streams and opportunities for creative expression. However, this shift has also brought about new challenges in income reporting and tax compliance. W2 forms, though traditionally associated with full-time employment, are relevant for gig economy musicians engaged as employees for specific events or projects. Accurate reporting of income from W2 forms is essential, but the irregular nature of gig work can make this process complex. Seeking professional tax guidance can help musicians avoid pitfalls and ensure they meet their tax obligations. As the gig economy continues to reshape the music industry, staying informed about income reporting and tax responsibilities is paramount for musicians aiming to thrive in this dynamic landscape.